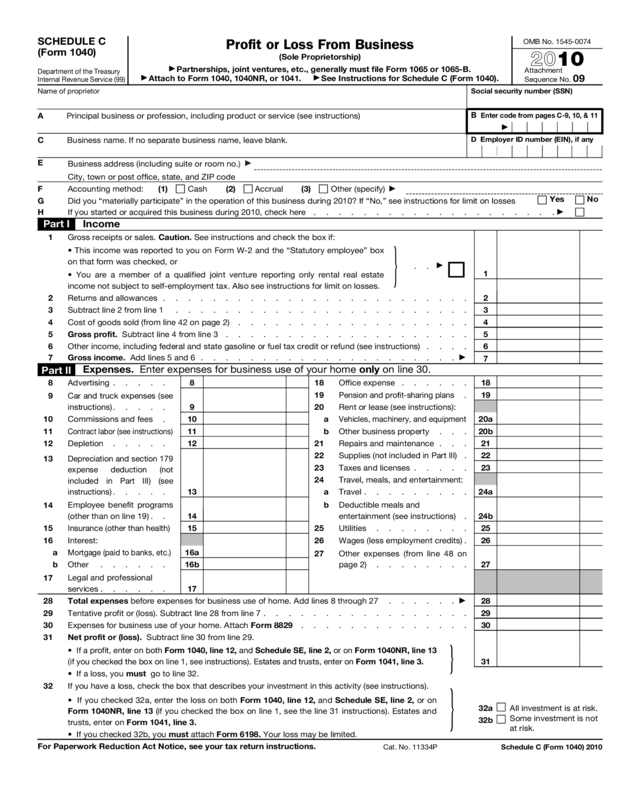

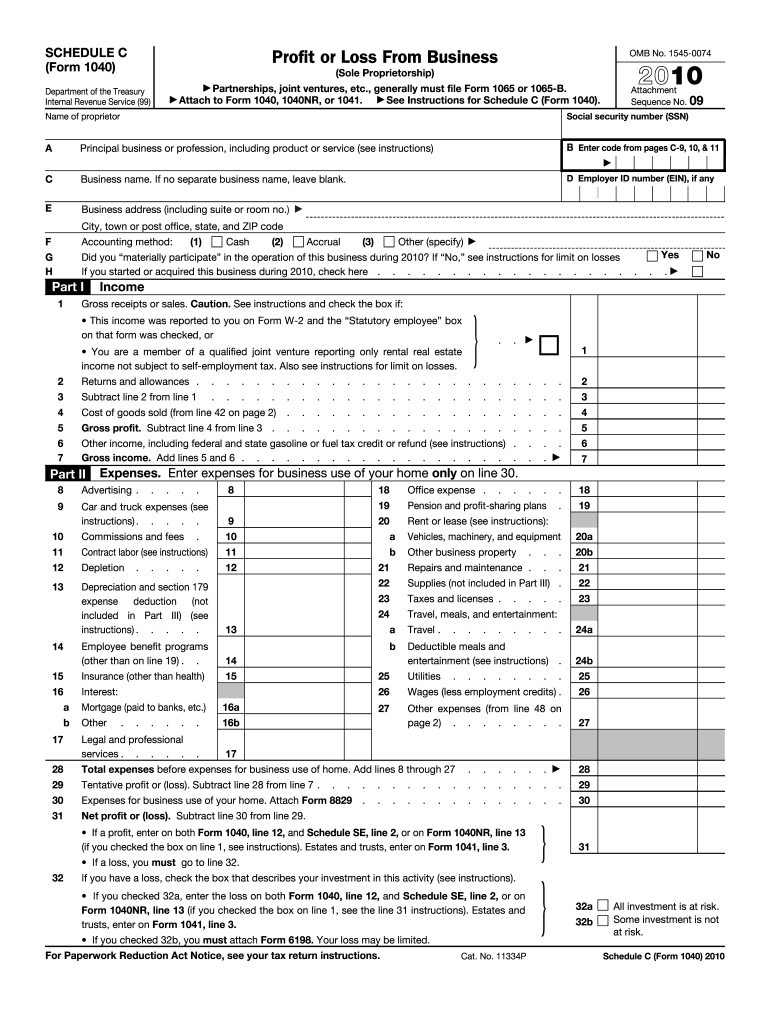

QuickBooks will ensure your books stay organized and can track your vehicle mileage. If you’re not using accounting software, we recommend QuickBooks Online. If you use an accounting software program to track your income and expenses, you can run your P&L report for the tax year and use that to complete each section of your Schedule C. You can either use a paper mileage log or a smartphone app to track your mileage. Mileage records: If you are using your personal vehicle for any business activity, it’s necessary to keep accurate mileage records to deduct those expenses.If you have less than $26 million in gross receipts, you’re not required to track inventory unless you’ve done so on a prior return. If you track inventory, make sure the cost of the inventory shown on your balance sheet matches your actual inventory. This can be done by completing an annual physical inventory and comparing that information with your point-of-sale (POS) or other inventory management software. Inventory count and valuation as of the end of the tax year: For businesses that sell items, you’ll need to determine the cost of the goods that you sold during the tax year.If you need bookkeeping software to generate your P&L report, see our guide to the best accounting software for sole proprietors and freelancers. This can be located on the IRS notice that you receive after submitting your Form SS-4, the Application for Employer Identification Number. Your EIN: If you have a separate EIN for your business, you must include it on your Schedule C.The IRS’s instructions for Schedule C: Our article explains how to complete your Schedule C, but the form instructions are handy for identifying the Principal Business or Professional Activity code for your business.Here are the five things you’ll need to complete the form: If this isn’t your first year filing Schedule C, have your prior Schedule C available as it will provide a lot of the required information. You’ll also want to have your general business information ready, like your employer ID number (EIN) if you have one.

No matter how that you compile your income and deductions, a few simple bookkeeping tips can make the process much easier. Step 1: Gather the Necessary Business Informationīefore filling out your Schedule C, you need to prepare your P&L report for the prior year. Your 2022 Schedule C is due on or before April 18, 2023.ĭownload this IRS Schedule C Form and follow along as we walk through the steps on how to fill out Schedule C for your sole proprietorship or single-member LLC.

0 kommentar(er)

0 kommentar(er)